Your Mortgage Relief Options During COVID-19

When the nation paused on the economy earlier this year and unemployment rates shot up dramatically; many homeowners were instantly worried about being able to afford their home mortgages. Two safety plans were put in place to better support those in need in order to assist in this tough period.

First, for government-backed mortgage loans, a hold was imposed on starting foreclosures. This plan began on 18 March 2020 and will continue until at least 31 December 2020. Secondly, for up to 180 days, homeowners were entitled to seek forbearance; followed by a possible extension for up to another 180 days. This way, there is a time of relief in which homeowners have the option to halt payments for up to one year on their mortgages.

Not Everybody Knows Their Options

The challenge, according to Matt Hulstein, Staff Attorney at non-profit Chicago Volunteer Legal Services, is, “A lot of homeowners aren’t aware of this option.”

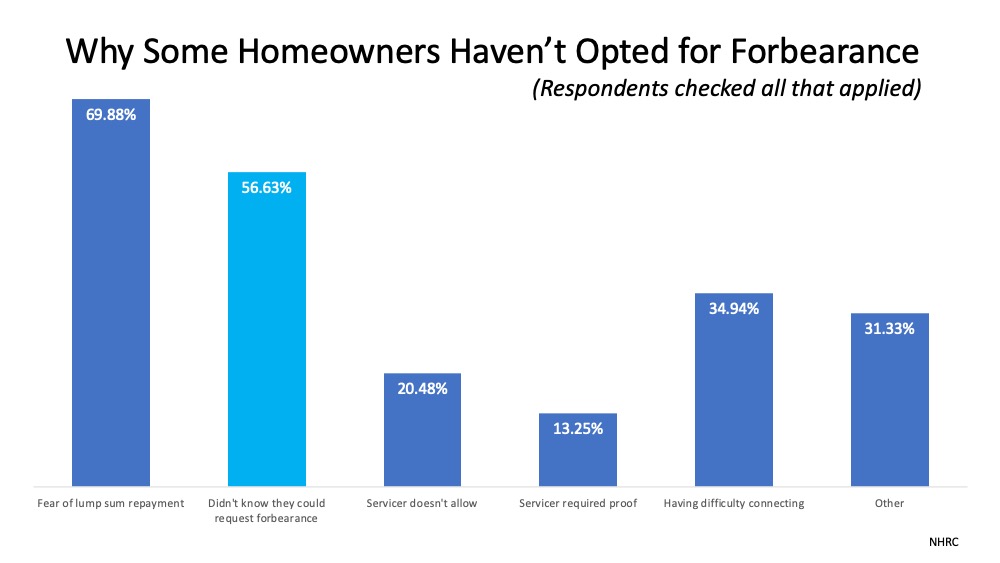

Behind this argument, there is certainly momentum. Housing counselors from around the country noted in a new survey by The National Housing Resource Center; many homeowners just don’t know that support is accessible. The following graph illustrates the reasons why individuals who are in this tough situation do not want to give up:

The Urban Institute explained:

“530,000 homeowners who became delinquent after the pandemic began did not take advantage of forbearance, despite being eligible to ask for the plan…These responses reflect a need to provide better information to all homeowners. (Lump-sum payment is not the only repayment option.)

Additionally, 205,000 homeowners who did not extend their forbearance after its term ended in June or July became delinquent on their loans. We need to examine who these people are and why are they not extending their option.”

It is clear, for many people, a more concentrated effort on education about forbearance and relief services will make a huge difference; and it is mission-critical to clearly understand their choices. However, the economic difficulties of the pandemic have affected some societies more than others; further confirming the need for education to be provided more broadly. Also suggested by the Urban Institute:

“Black and Hispanic homeowners have been hit harder than white homeowners…nearly 21 percent of both Black and Hispanic homeowners missed or deferred the previous month’s mortgage payment, compared with 10 percent of white homeowners and about 13 percent of all homeowners with payments due.”

Available Options

It is necessary to remember that the right to request forbearance is granted to any homeowner suffering financial hardship. To explore your options, contact your mortgage lender (the company you send your mortgage payment to each month); if you are unfamiliar with the plans available. It is a required next move, as you can qualify for options or forbearance for mortgage relief.

In this time of need, one choice many homeowners may not know they have is the opportunity to sell their property. With the increasing equity that homeowners have available today, the best way to secure your financial future might be to make a change.

Bottom Line

You can check the Protect Your Investment Guide from the National Association of Realtors ( NAR); and the Consumer Financial Protection Bureau (CFPB) Homeowner’s Guide to Success if you need more information on your choices. Our home is the most valuable asset we have for the majority of individuals, and you can use all the support available right now to be able to sustain your investment.