Best Time To Buy A Retirement Home – 10 Tips For A Success

- In this post, we are going to share our 10 steps to follow to make your retirement home feel like your dream home.

- National Association of Realtors® View On Retirement Home

- Why Are These Homeowners Moving?

- 10 Tips for Success – Follow these ten steps to make sure that buying a home after retirement does, in fact, feel like a dream:

- Bottom Line

- LET’S KEEP IN TOUCH!

In this post, we are going to share our 10 steps to follow to make your retirement home feel like your dream home.

About 10,000 people in the U.S. become 65 every day and are thinking about retirement. Before the health crisis that swept the nation in 2020, many people had to wait until they retired to move to their later years in life on the beach; on the golf course, or in the senior living community. But the game changed this year.

Many of the workers of today who are close to the end of their careers, but are perhaps not ready to retire, have a new choice; do I have to move before I retire? If the sand and sun call your name and you have the ability to work remotely in the foreseeable future, it’s now a good time for you to buy a beach bungalow or a single-story house in the vast countryside a short way from the city.

Whether it’s a second home or a new retirement home, the best way for you to complete a long and meaningful treatment in the next few years; can be to truly smile each day might be the best way to round out a long and meaningful career.

National Association of Realtors® View On Retirement Home

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

The 20th annual Transamerica Retirement Survey shows that 3 out of every 4 retirees own their own homes (75%), and only 23% have hypothecary debt (including any credit lines or equity loans). Almost 4 out of 10 retirees (38%) have moved to a new home since retirement. They benefit by marketing their existing homes and using their equity to buy their new retirement homes in today’s low-inventory market. It’s a victory.

Why Are These Homeowners Moving?

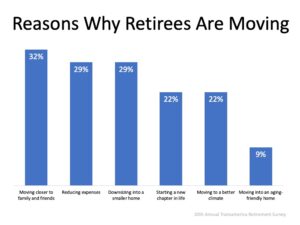

The health crisis this year has made us all more aware of the significance of our family and friends and since the pandemic started, many of us have not seen our larger families. It is therefore no surprise that in the same report, 32 % of the respondents mentioned the main reason that they move is that they want to be closer to family and friends (see chart below):

The survey also found that 73% of retired people now live in homes with one family. With a historic low overall sales of homes and the buyer’s demand for single-family homes rising steamily, the time to sell one single-family home and take retirement has never been more ideal. The market today combines perfect driving forces for optimum selling, in particular when buyers want to use low-interest rates.

10 Tips for Success – Follow these ten steps to make sure that buying a home after retirement does, in fact, feel like a dream:

-

Talk to your significant other: If you have a significant other, it’s important to have a conversation about your desires. Don’t assume that you’re both on the same page. Have several talks about what kind of home and lifestyle you desire. This may require some compromise, but make sure to reach an agreement where you can both be happy.

-

Test it out: Whether you plan to move across the country or into a retirement community, make sure to test out your vision. Someone who likes the idea of living in a community might find that they don’t enjoy abiding by rules. Subsequently, someone who wants to move to Arizona may discover they don’t enjoy hot weather. Spend time visiting different retirement communities or vacationing in various destinations to find out what environment suits you best.

-

Take mobility into consideration: Make sure to factor in mobility when picking out a place to live. Assuming that you’ll always be able to drive is a mistake. Instead, be sure to measure walkability and the availability of public transportation. Ensure that you’ll be able to get to important places, such as the hospital or the grocery store, even without a car.

-

Pay attention to accessibility: In addition to mobility, be sure to pay attention to accessibility when looking at properties. Single-story properties are a popular choice amongst retirees, as they cut out the need for stairs. Other features to look for include wide entryways and hallways, step-in showers, and rooms that provide enough space to move around in a walker or wheelchair. Even if accessibility is not a current concern, keep in mind that retrofitting a property to become wheelchair accessible can be very expensive.

-

Remember your friends and family: Many people dream of retiring to a faraway destination, such as a beach town or even abroad. However, before you leave your old life behind, be sure to consider how big of an impact leaving your support network can have.

{RELATED – Selling Your Own Home – 7 Proven Steps}

-

Work out a post-retirement budget: Sit down with a financial advisor and work out a realistic post-retirement budget. Getting an idea of your monthly retirement income and expenses now can help you identify areas that need more preparation. This can also be a great time to look into passive income opportunities to help boost your post-retirement income.

-

Buy based on your future income: For those buying a retirement home early, be sure to calculate how much house you can afford based on your post-retirement budget, and not by your current income. Even if your monthly income were to stay roughly the same, the amount you can afford to spend on home-related expenses may change significantly.

-

Assess the impact on your taxes: Be sure to take a look at the possible financial implications when planning to move to a new state or country. Some states have high property taxes, making your investment that much more expensive. Also, look into how your retirement income taxes and exemptions will be impacted based on your move.

-

Be realistic about home-related expenses: Be sure to factor in home-related expenses when calculating your home-buying budget. Costs may increase or decrease based on the age and condition of the property, severity of the weather, or whether or not your future home is part of an HOA or retirement community.

-

Make a down payment wisely: Some individuals are tempted to put their life savings toward a down payment to lower their monthly mortgage payments. However, this strategy can lead you to be house rich and cash poor, leaving little wiggle room for unexpected expenses or emergencies. Sit down with your lender and financial advisor to choose the right mortgage option and debt structure that best suit your needs.

If you are one of the 73% of retirees with a single-family house and want to get closer to your family, the time is right to market your house. Today, you can essentially complete your move – beginning to conclude – before the holidays, thanks to the pace homes.

Bottom Line

Regardless of the fact that you want to retire or purchase a second home to make it a future retirement home, the housing market in 2020 can work very well for you. Let’s talk about your options on the local market today.