Homeownership is one of the simplest ways to take a position in your financial future, especially as your home equity grows. Home equity may be a sort of forced savings that will work to your advantage as the value of your home appreciates. In the Maryland area, home equity was increasing before the health crisis swept our nation. It continues to grow throughout the year, giving sellers powerful options during this market.

According to the just-released Q2 Homeowner Equity Insights Report by CoreLogic:

“U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a complete of nearly $620 billion since the second quarter of 2019, a rise of 6.6%, year over year.”

Dr. Frank Nothaft, Chief Economist for CoreLogic, attributes much growth to rising home prices:

“The CoreLogic Home Price Index registered a 4.3% annual rise in prices through June, which supported an increase in home equity.”

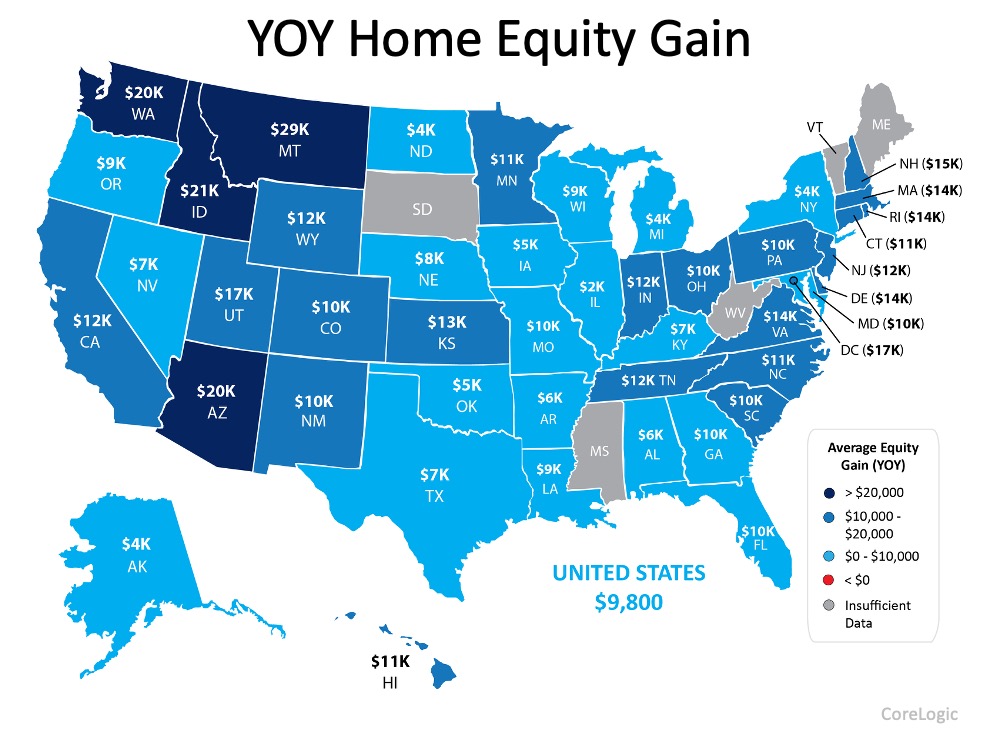

CoreLogic also indicates that home equity is increasing in every state:

“In the second quarter of 2020, the average homeowner gained approximately $9,800 in equity during the past year.”

What Does This Mean for Sellers?

When equity is rising, because it is today, you’ll have more invested in your home than you realize. Mark Fleming, Chief Economist at First American, notes:

“As homeowners gain equity in their homes, they’re more likely to think about using it to get a bigger or more attractive home. In today’s housing market; fast rising demand against the limited supply of homes purchasable has resulted in continued house price appreciation.”

Suppose you’ve been considering making a move, whether that’s to urge into a much bigger home or to downsize to a smaller one. It’s an excellent time to contact a real estate professional to be told how to put your equity to figure for you. You’ll be in a great position to put toward your next home purchase and afford it sooner instead of later.

What is home equity?

Home equity is the share of your home that you actually own — the difference between its market value and the money you owe on your mortgage. “It’s the amount you would net if you sold your home and paid off your mortgage.”

To calculate how much equity you have in your home, subtract your loan balance from your home’s total value. Then divide that number by the value. For example, if you had $150,000 remaining on your loan and a home worth $200,000, you’d have 25% equity ($50,000 / $200,000).

You increase your home equity by paying down your mortgage. The more you reduce your loan balance, the more equity you have, and the more you’ll make when it’s time to sell.

Keep in mind that mortgage loans are amortized — meaning your monthly payment goes toward interest first and then toward your principal balance. In the beginning, when your balance is highest, that means monthly payments reduce the loan balance very little, resulting in only a small amount of equity gained in the first few years. If you’re looking to whittle down your balance quickly and increase your equity stake, you’ll want to consider making extra payments toward your principal (tax refunds can help here).

Still, paying down your debt isn’t the only way to build equity. Equity also rises and falls based on the value of your home. If you make certain improvements to the property or home prices rise in your area, so does the home’s value, and that pushes your equity stake up with it.

It’s the latter that’s primarily behind today’s rising equity. “Increasing levels of equity are overwhelmingly a function of rising home prices in recent years. “We’ve now seen over eight consecutive years of positive home price growth, with the average home price setting a new record high in each of the past eight months.”

Bottom Line

If you want to know the value of your home, click the link below. http://annareed.idxbroker.com/idx/homevaluation.